Running a small business is no small feat. Between managing sales, chasing payments, filing GST, and keeping your team aligned, the last thing you need is to get bogged down in messy spreadsheets or outdated ledgers. That’s where accounting software steps in — helping you stay compliant, cash-conscious, and growth-ready.

But with so many options out there, one of the most common questions we get at 21DEGREES Advisory Services Private Limited is:

“Which accounting software is best for my business?”

Let’s break it down in plain English.

First, What Should You Be Looking For?

Every business is different, but when choosing accounting software in India, you want something that covers the essentials:

- GST Compliance: Auto-generated reports, e-invoicing, and return filing

- Ease of Use: A clean interface you and your team can understand

- Bank Reconciliation: Seamless integration to track income & expenses

- Scalability: Can it grow with you as your business expands?

- Cloud Access: For remote teams, mobile access, and real-time tracking

- Integration with Your CA or Bookkeeper: The smoother, the better

Once you know what you need, the shortlist becomes clearer.

Top 3 Accounting Software Options for Indian Small Businesses

1. Zoho Books – “Built for Indian SMEs”

Zoho Books is our top recommendation for startups, service businesses, and digital-first founders. It’s a cloud-based platform that offers:

- GST filing made easy (GSTR-1, 3B, and reconciliation)

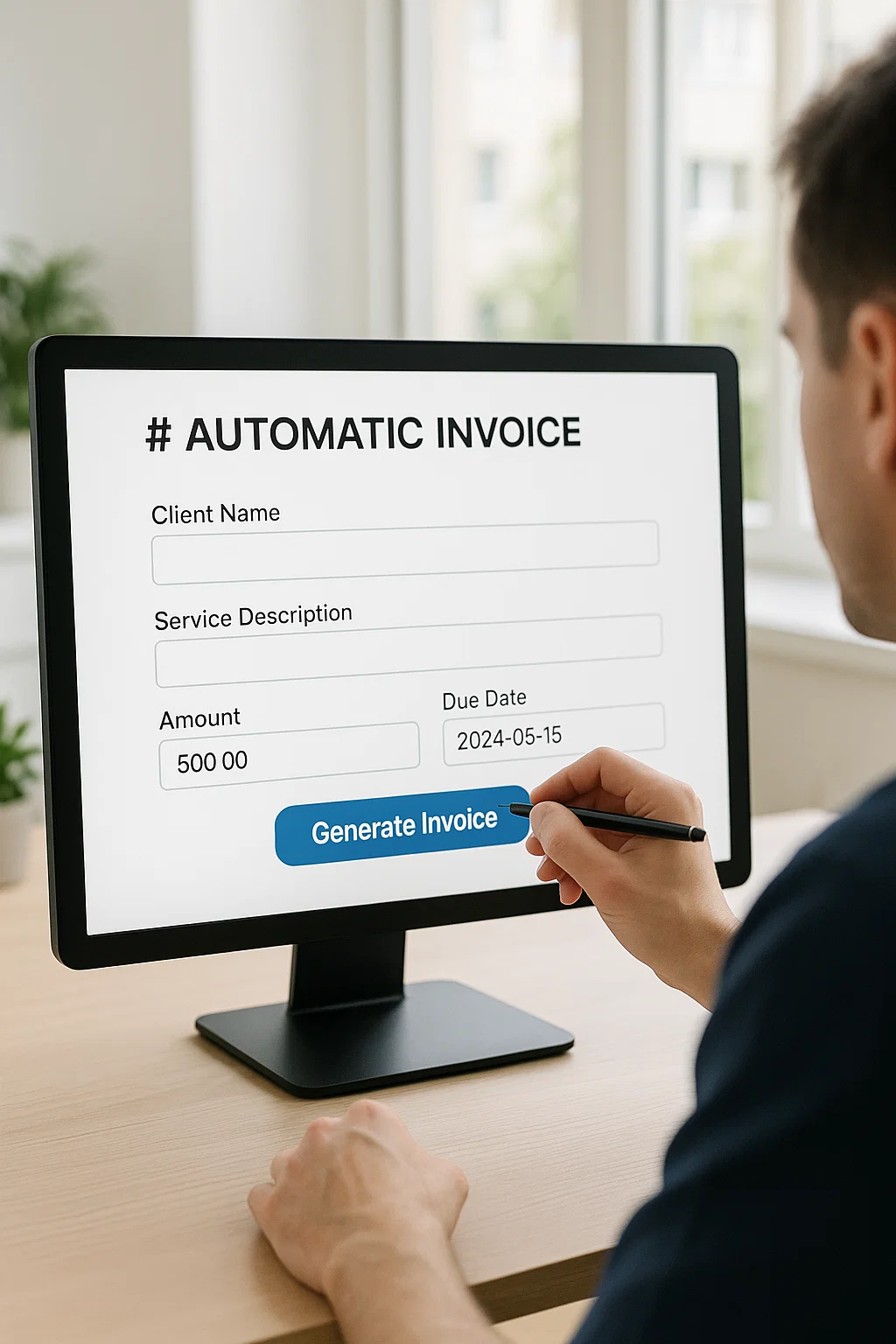

- Custom invoicing and payment reminders

- Automated bank feeds

- Inventory tracking (great for product companies)

- Vendor and client management

💡 Pro tip: Zoho Books even supports e-invoicing and integrates with other Zoho apps like CRM and Payroll — making it a powerful one-stop ecosystem.

2. TallyPrime – “The trusted Indian classic”

Tally is practically a household name for Indian businesses. While it’s not as visually modern or cloud-native, it’s still incredibly reliable — especially if you have a traditional setup or an accountant who prefers working offline.

TallyPrime offers:

- Robust inventory and purchase management

- Strong accounting and ledger functions

- Easy GST billing and return generation

- Tally on cloud options via third-party services

If your operations are warehouse-heavy or you have in-house finance staff trained on Tally, this may be a solid pick.

3. QuickBooks (India) – “Global, but with caveats”

While QuickBooks pulled direct operations from India, it’s still used widely by startups and export-oriented businesses with international clients.

It excels in:

- Dashboard simplicity and great user experience

- Recurring billing and subscriptions

- Global payment support (ideal for SaaS or freelancers)

- Cash flow reports and visual insights

That said, support can be limited unless you work with an accountant familiar with it or a virtual CFO like us who can set it up and manage the backend for you.

So, Which One Should You Choose?

Here’s a simple way to look at it:

| Business Type | Best Software |

| Startup/Service | Zoho Books |

| Traditional Setup | Tally Prime |

| Global billing or SaaS | Quick Books |

But remember — software alone won’t save your books.

The real magic happens when tools are paired with the right processes and expertise.

How 21DEGREES Advisory Services Can Help

At 21DEGREES, we don’t just recommend a tool and walk away. We:

- Help you choose the right accounting software

- Set it up for your specific industry and size

- Automate recurring entries, invoicing, and tax reports

- Work with your CA or become your virtual finance team

- Give you real-time dashboards and investor-friendly reports

Ready to streamline your finances?

Let’s make your accounting smart, simple, and scalable.

Visit 21degrees.in — and let’s find the perfect financial fit for your business.