what a shopowner should do for GST rates update.

Big news for retailers: GST rates are changing on September 22, 2025. For many shop owners, this brings a wave of questions: What do I do with my old stock? How do I update my billing system? And how do I manage my cash flow?

Don’t worry. This isn’t about complicated tax law; it’s a practical, step-by-step guide to help you navigate the transition smoothly. Let’s walk through exactly what you need to do to be prepared.

First Things First: Know the New Rates

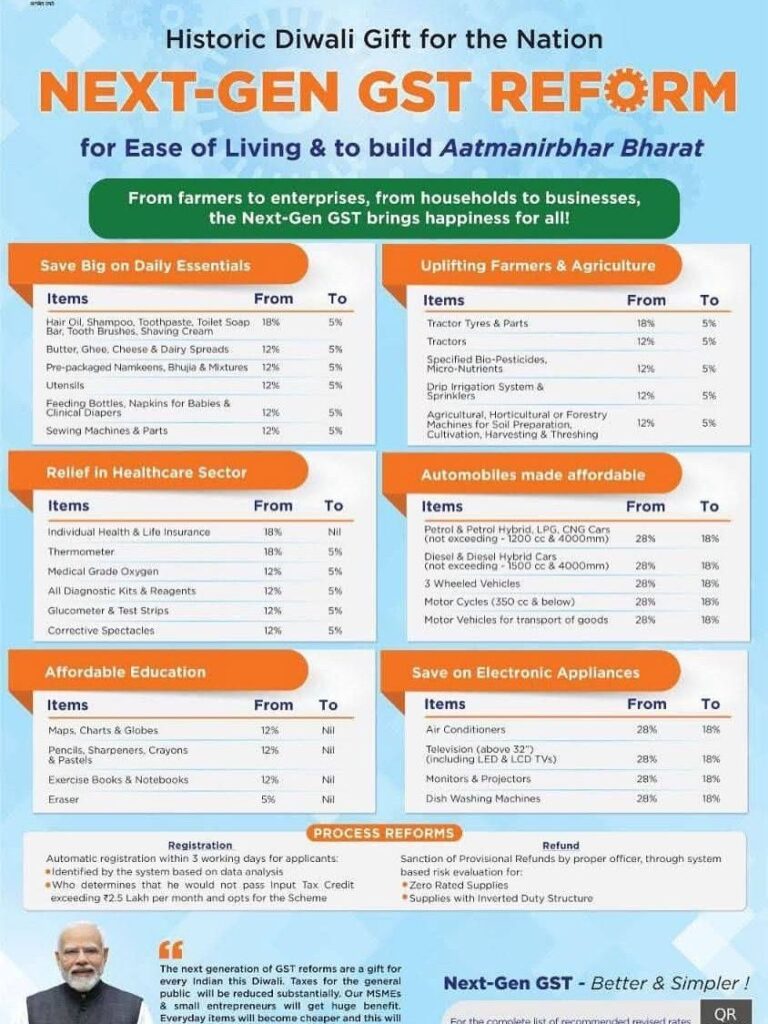

Before anything else, identify which of your products are affected. The government has restructured the slabs, and here’s what the new landscape looks like:

- 0% (Nil Rate): Essential staples like UHT milk, paneer, and Indian breads (roti/paratha).

- 5% (Merit Rate): Many daily-use items are moving here. Think hair oil, soaps, shampoos, toothbrushes, as well as bicycles, tableware, namkeen, chocolates, and pasta.

- 18% (Standard Rate): This remains the default rate for most other goods and services not specified elsewhere.

- 40% (Sin/Luxury Rate): Reserved for items like tobacco products and other specified luxury goods.

The biggest shift for most general stores will be everyday items dropping from higher rates to the 5% slab.

Your Pre-September 22nd Action Plan

Proactive steps taken now will save you major headaches later. Focus on these two key areas:

1. Tally Your Stock

Conduct a thorough physical inventory count of all items that will have a new GST rate. For each product (like hair oil, soap, or chocolates), create a detailed list documenting:

- Product Name & HSN Code

- Quantity on Hand

- Current GST Rate (the rate you paid your supplier)

- New GST Rate (the rate you will charge from Sept 22)

- Original Purchase Invoices (keep them handy!)

This list will be your master document for managing the transition.

2. Update Your Tech & Tools

Your systems need to be ready to go live with the new rates on day one.

- Point of Sale (POS) System: Contact your software vendor or manually update the tax rates in your billing system. Run a test invoice to ensure it’s calculating correctly.

- Price Tags & Labels: Prepare new price labels for your shelves. The benefit of a tax reduction must be passed on to the customer. If an item moves to a lower tax slab, its final price should decrease.

- Invoice Templates: Ensure your printed and digital invoice formats are updated to reflect the new GST rates for each item.

The Million-Rupee Question: What About Existing Stock?

This is the biggest challenge. The rule is simple but has major implications: GST is charged at the time of supply.

This means it doesn’t matter when you bought the product; it matters when you sell it.

- If you sell goods on or after September 22, you must apply the new GST rates.

- This applies even if you purchased the stock weeks ago at the old, higher rate.

Real-World Scenario: Imagine you own a general store.

- In August, you bought 100 bottles of hair oil, paying your distributor 18% GST.

- The rate drops to 5% on September 22.

- In October, you sell one of those bottles to a customer.

The outcome: You must charge the customer the new 5% GST rate, even though you paid 18% GST when you acquired the stock. This will create a temporary financial mismatch.

Protecting Your Cash Flow: ITC & Pricing

The mismatch we just discussed directly impacts your finances. Here’s how to manage it.

Leveraging Your Input Tax Credit (ITC)

Because you paid higher GST on purchases (e.g., 18%) than what you’ll collect on sales (e.g., 5%), you will accumulate excess Input Tax Credit (ITC). This is essentially the government owing you money. You have two primary options:

- Offset Other Liabilities: Use this excess ITC to pay the GST on other products that are still in the 18% slab.

- Claim a Refund: If you don’t have enough other liabilities, you can file for a cash refund. The government has promised a streamlined process, including 90% provisional refunds within 7 days, to help businesses manage their working capital.

Smart Pricing Strategy

You are legally and ethically expected to pass the full tax cut benefit to your customers.

- Example: If a bottle of hair oil cost you ₹100 + 18% GST (Total MRP ₹118), the new price should be ₹100 + 5% GST (New MRP ₹105).

- Best Practice: Document your price changes. Keep records of old and new price lists to show that you have passed on the benefits, which aligns with pro-consumer practices.

Your Time-Sensitive Checklist

Immediate Actions (Before September 22):

- Conduct your full inventory assessment.

- Update your POS and billing software.

- Train your staff on the new rates and pricing.

- Prepare new price tags for affected products.

- Inform regular B2B customers about the upcoming changes.

On September 22:

- Officially switch your billing systems to the new rates.

- Replace old price tags on shelves with the new ones.

- Start meticulously documenting sales with the new rates.

Post-Implementation (Late Sept / Oct):

- Monitor your ITC accumulation in your GST filings.

- File for ITC refunds promptly if necessary.

- Reconcile your stock records with sales data.

Special Considerations

- Bundled Products: If you sell combo offers (e.g., a soap at 5% bundled with a cosmetic at 18%), review the rules for mixed supply to ensure you’re charging the correct rate.

- E-commerce: If you sell online, coordinate with your platform (e.g., Amazon, Flipkart) to ensure their systems reflect the new rates at the exact same time as your physical store.

- Supplier Communication: Talk to your distributors. They are undergoing the same change. Discuss any potential for transition support on inventory purchased just before the rate change.

The Bottom Line

A GST rate change requires careful planning, but it’s entirely manageable. The key is to be organized, update your systems ahead of time, and communicate clearly with your staff and customers. By following these steps, you can ensure a seamless transition, maintain healthy cash flow, and build trust with your customers by passing on the tax benefits.