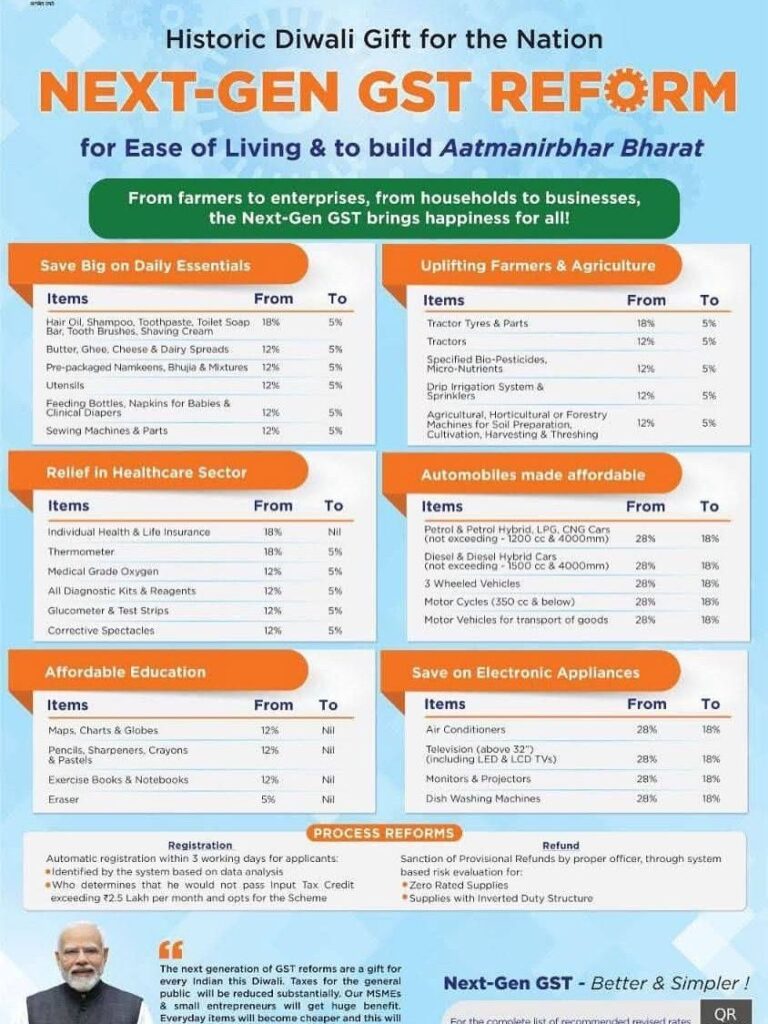

GST REFORMS

Let me walk you through exactly what you need to do as a shop owner when the GST rate changes take effect on September 22, 2025. This is a practical, step-by-step guide covering everything from your existing inventory to updating your systems.

Understanding Your Situation

First, let’s identify what category your products fall into. The new GST structure is:

- 0% (Nil Rate): UHT milk, paneer, Indian breads (roti/paratha)

- 5% (Merit Rate): Hair oil, soaps, shampoos, toothbrushes, bicycles, tableware, namkeen, chocolates, pasta

- 18% (Standard Rate): Most other goods and services

- 40% (Sin Goods): Tobacco products, luxury items

What You Must Do Before September 22

1. Inventory Assessment and Valuation

Check Your Stock Position: Conduct a complete inventory count of all items that will see rate changes. For example, if you sell hair oil (moving from 18% to 5%), soap bars, or chocolates.

Document Everything: Create a detailed list with:

- Product names and quantities

- Current GST rates being charged

- New GST rates applicable from September 22

- Purchase invoices and dates

2. System Updates Required

Point of Sale (POS) Systems: Update your billing software to reflect new tax rates. Most modern POS systems will require manual rate updates or software patches.

Price Tags and Labels: Prepare new price labels showing reduced prices for items moving to lower tax slabs. Remember, the benefit should reach customers.

Invoice Templates: Update invoice formats to show correct GST rates and HSN codes.

Handling Existing Inventory: The Critical Challenge

Time of Supply Rules

This is crucial – the GST rate applicable depends on when you actually supply the goods, not when you purchased them:

If you supply goods after September 22: New rates apply, regardless of when you bought the inventory.

If you received advance payments before September 22: The rate depends on when the actual supply happens.

Practical Example

Let’s say you own a general store and have:

- 100 bottles of hair oil purchased at 18% GST in August

- You’ll sell them in October after the rate drops to 5%

What happens: You must charge customers only 5% GST (new rate) even though you paid 18% when purchasing. This creates a temporary cash flow impact.

Managing the Financial Impact

Input Tax Credit (ITC) Adjustments

Excess Credit Situation: Since you paid higher GST on purchases but will collect lower GST on sales, you’ll accumulate excess Input Tax Credit.

What you can do:

- Use excess ITC against other tax liabilities

- Claim refunds for genuine excess credits

- The government has promised faster refund processing (90% provisional refunds within 7 days)

Pricing Strategy Decisions

Full Benefit Pass-through: You’re expected to pass the complete tax reduction benefit to customers. If hair oil was ₹100 + 18% GST (₹118 total), it should become ₹100 + 5% GST (₹105 total).

Inventory Cost Recovery: While there’s no legal obligation, you might temporarily absorb the difference between what you paid and what you collect to remain competitive.

Compliance and Documentation

Record Keeping Requirements

Maintain Detailed Records:

- Purchase invoices with old rates

- Sales invoices with new rates

- ITC claims and reversals

- Stock movement registers

GST Return Impact: Your GSTR-3B returns will show the impact of rate changes. Ensure accurate reporting of ITC reversals and claims.

Time-Sensitive Actions

Immediate (Before September 22):

- Update all pricing systems

- Train staff on new rates

- Prepare customer communication materials

- Test billing systems with new rates

On September 22:

- Switch to new rates for all applicable items

- Start charging customers new rates

- Begin documenting rate change impacts

Post-Implementation:

- Monitor ITC accumulation

- File for refunds if needed

- Track customer response to price changes

Special Considerations

Mixed Supplies and Bundling

If you sell product bundles or combo offers, review how different rates apply to different components.

E-commerce Integration

If you sell through online platforms, coordinate with them to ensure rate updates are synchronized across all channels.

Distributor and Supplier Coordination

Upstream Impact: Your suppliers will also adjust their rates. Negotiate with suppliers about inventory purchased at old rates but sold at new rates.

Downstream Communication: Inform regular customers about price changes due to GST rate modifications.

Anti-Profiteering Compliance

Passing Benefits to Customers

While the anti-profiteering authority was disbanded in April 2025, the government and industry bodies like CII have committed to ensuring tax benefits reach consumers.

Best Practice: Document that you’re passing the full benefit to customers through:

Cash Flow Management

Working Capital Impact

Temporary Squeeze: You might face a temporary working capital challenge as you paid higher taxes on inventory but collect lower taxes on sales.

Mitigation Strategies:

- Apply for faster ITC refunds

- Use excess credits against other liabilities

- Plan inventory purchases around the transition date

The key is to stay organized, update your systems promptly, and ensure you’re passing the benefits to your customers while managing the temporary financial impact of the transition. The government has provided mechanisms for faster refunds and support, so use them effectively to maintain healthy cash flows during this transition period.